2023

Benefits at a Glance

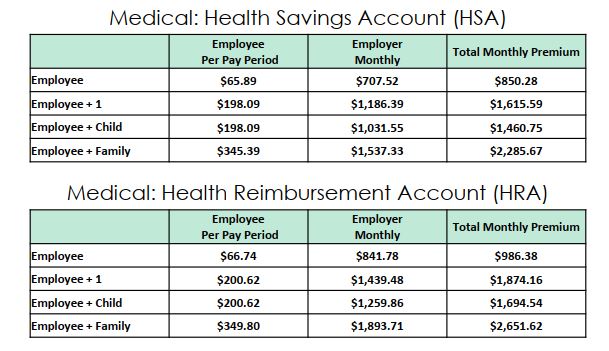

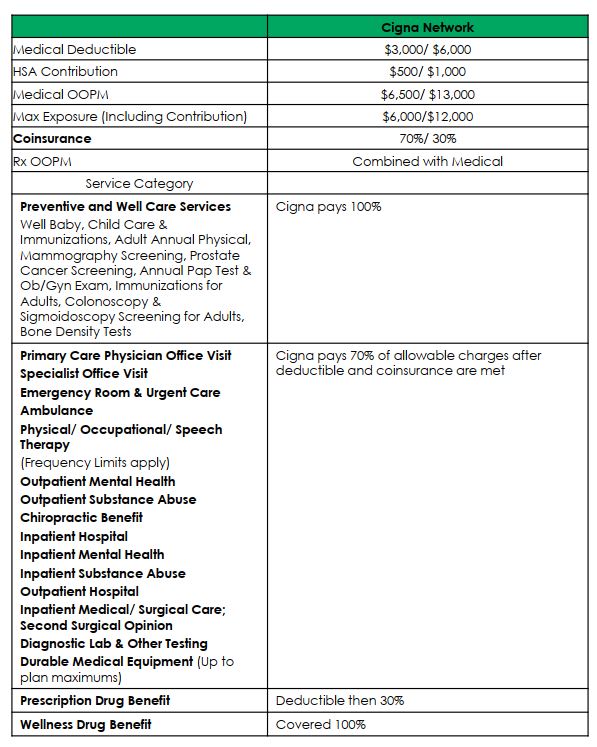

Your Medical Benefits

ACHHH offers two contributory plans from Cigna.

Summary of Benefits and Coverage

Summary of Benefits (SOB)

Summary of Benefits (SOB)

Contributions

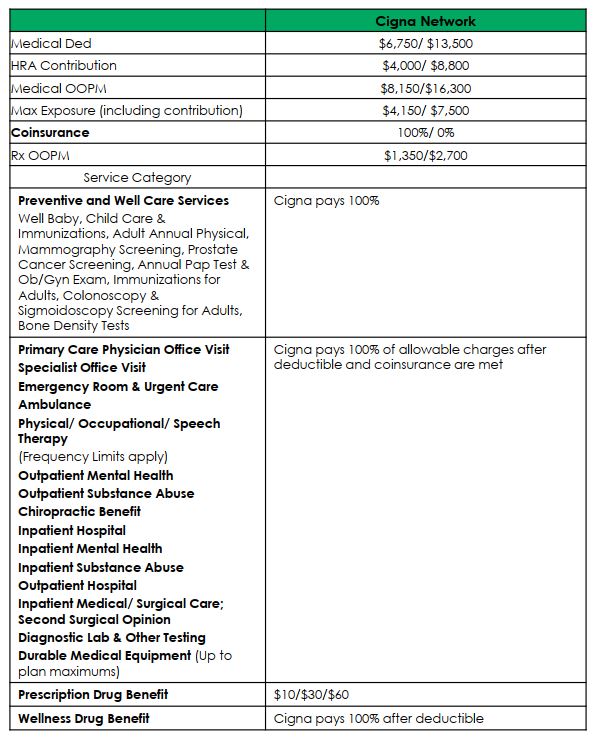

Health Reimbursement Account

ACHHH will be offering a Health Reimbursement Arrangement to active employees selecting the HRA Medical plan. The HRA is administered by Cigna.

In 2023, ACHHH will be contributing $4,000 for a single, and $8,800 for a family.

HRA funds can be spent on your medical Deductible and Coinsurance up to your plan Out of Pocket Maximum.

HRA Coverage

Eligibility:

All full-time employees who work at least thirty hours per week are eligible for coverage the first of the month following thirty days from their date of hire.

Contact Information

New with all Medical Enrollments - FREE Identity Theft Protection

- NEW- included with your Cigna Medical plans, you have the option to enroll in Cigna’s Identity Theft Protection at NO COST

- “It’s Here” notification in January, the member will receive an email that will include enrollment instructions

- No cost to clients and medical subscribers. Children living in the subscriber household (under age 26) can be added to the subscriber account for monitoring. There is no additional fee to add children to the subscriber profile.

- There is an option to upgrade to Family Coverage if a subscriber wishes to add their spouse. The fee is heavily discounted through our offering and will be billed directly to the subscriber for the duration of the family membership. This membership profile will be managed between Sontiq and the member.

Your Health Savings Account and Dependent Care Account Benefits

Health Savings Account

In 2023 ACHHH will contribute $500 for a single, and $1,000 for a family.

You may also contribute your own funds to your HSA and save up to $3,850 single and $7,750 family, with a $1,000 catch-up after age 55—including the ACHHH contribution.

- For 2023, the HSA is offered through Cigna, which includes investment options.

- HSAs are individually owned and managed by the employee.

- Money can be used for any un-reimbursed medical, dental or vision expenses.

- HSA contributions by employer and employee are done on a pre-tax basis and there is no “use it or lose it” rule.

- Employees will receive a Debit Card for their HSA & may use this card to pay for bills from providers & for prescription costs at retail & mail order pharmacies.

- Funds in an HSA rollover from one year to the next & can be taken with you when employment ends.

Dependent Care Account

The Dependent Care Flexible Spending Account allows employees to use pre-tax dollars towards qualified dependent care such as caring for children under age 13 or elder care. The annual maximum amount you may contribute to the Dependent Care FSA is $5,000 (or $2,500 if married and filing separately) per calendar year. Dependent Care is handled in house, by ACHHH.

HSA Coverage

ACHHH will offer payroll deduction support, so you may elect to make pre-tax contributions direct to your account from your paycheck. You may make or change your DCA contribution election on Employee Navigator.

Eligibility:

All full-time employees who work at least thirty hours per week are eligible for coverage the first of the month following 0 days from their date of hire.

Contact Information

- Log on to myCigna.com or dowload the myCigna mobile app.

- Click on “Visit your HSA bank to manage your account” to link to the HSA Bank Customer Website

Facets HSA Bank Customer Welcome Flyer

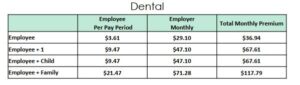

Your Dental Benefits

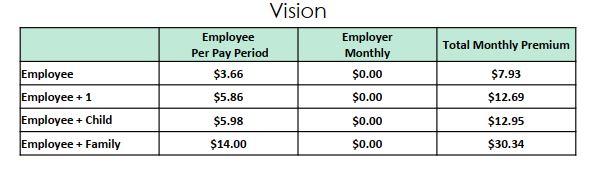

Your Vision Benefits

ACHHH offers one vision plan through VSP.

Contributions

Eligibility:

All full-time employees who work at least thirty hours per week are eligible for coverage the first of the month following date of hire.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Your Group Life Benefits

ACHHH provides their employees with a group life and accidental death and dismemberment benefit.

- Coverage is 1.5 times an employee’s gross annual salary, not to exceed $150,000

- AD&D doubles the Life Insurance payout if death results from an accident

- The premium cost is paid by ACHHH and is a tax-free fringe benefit to the employee

- Benefit reduces to 65% at age 70 and 50% at age 75

Contributions

This is 100% Employer paid.

Eligibility:

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Your Short Term Disability Benefits

ACHHH offers employees short term disability coverage. This plan is designed to provide a continuation of benefits to you in the event of either sickness or accident.

- Benefit begins after a 7 day elimination period

- The elimination period is the amount of time after the onset of a disability (illness or accident)

- Benefit is 66 2/3% of your weekly income

- Maximum benefit is $500/week

- Maximum benefit period is 25 weeks

Contributions

This is 50% Employer paid and 50% Employee paid.

The monthly cost of STD is $0.87 per $10 of total weekly benefit

- If you make $750/week, your monthly premium would be $32.63

- (750/10 X .87 / 2 = 32.63) (weekly benefit / 100 X .87 / 2 = Monthly Premium)

Eligibility:

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Your Voluntary Long Term Disability Benefits

ACHHH offers employees Long Term Disability coverage. This plan is designed to provide a continuation of benefits to you in the event of a disability.

- Benefit begins after a 180 day elimination period

- The elimination period is the amount of time after the onset of a disability

- Benefit is 60% of monthly to a max of $3,000

- Minimum monthly benefit $100

- Maximum benefit period to age 65 or SSNRA

Contributions

This is 100% Employee paid.

The monthly cost of LTD is $0.42 per $100 of monthly payroll

- If you make $3,000/month, your monthly premium would be $12.60

- (3,000/100 X .42 = 12.6) (monthly payroll / 100 X .42 = Monthly Premium)

Eligibility:

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Your Voluntary Life and AD&D Benefit

ACHHH offers voluntary life and accidental death & dismemberment benefits to eligible employees. Employees may elect Voluntary Term Life and Voluntary AD&D on themselves

- Elected amounts must be chosen in increments of $10,000, up to a maximum of $500,000 not to exceed 5 times annual earnings

- Employees may elect up to $100,000 or 5 times annual earnings, whichever is less, with no Evidence of Insurability upon initial eligibility

- Amounts over $100,000 or subsequent to initial eligibility require the employee to complete Evidence of Insurability

- AD&D coverage matches Voluntary Life election

- Benefit reduces to 65% at age 70 and 50% at age 75,

- You can also elect coverage on your spouse in increments of $5,000 from $5,000 to $250,000

- Amount for spouses cannot exceed 100% of employee election

- You may elect coverage on dependent child(ren) in $2,000 increments from $2,000 to $10,000

- AD&D will automatically match elected amount for dependents

Contributions

Eligibility:

All full-time employees who work at least thirty hours per week are eligible for coverage the first of the month following their date of hire.

Individual Life Insurance Policies

While nothing can replace you, having individual life insurance can protect your loved ones financially. The Richards Group is please to offer a simplified, 100% online solution to get individual life insurance coverage.

- No in-person medical exam necessary

- Just answer a few easy questions about your current health

- View options that fit your needs and budget

- Our AI-powered recommendation engine pulls options from trusted insurance agencies tailored to you and your family’s unique situation needs.

- Select and purchase a plan

- Get qualified instantly, or schedule an online consultation to determine the best fit. No need to wait for open enrollment – your plan is active in just 1-3 weeks from initial selection.

Your Voluntary Critical Illness Benefit

ACHHH offers voluntary critical illness benefits to eligible employees.

- Basic Benefit Categories:

- Heart/Circulatory

- Organ

- Childhood/Development

- Cancer

- All categories range from 25-100% Critical Illness Principal Sum

- The benefits payable under the policy is a maximum of 200% ($20,000) the Critical Illness Principal Sum.

Contributions

Eligibility:

All full-time employees who work at least thirty hours per week are eligible for coverage the first of the month following their date of hire.

Your Voluntary Accident Benefits

ACHHH offers voluntary accident benefits to all eligible employees.

- Basic Benefits:

- Initial Care & Emergency: Up to $1,000

- Specified Injuries: Up to $15,000

- Hospital Surgical & Diagnostic: Up to $400 per day & $1,000 for admission

- Follow Up Care: Up to $750

- Within each category, benefits are payable up to the amount shown, depending on the type of injury sustained or the type of medical treatment that is received in result of an accident.

- Other benefits include: Fractures, Dislocations, Follow-Up Care and others

- In addition Basic Benefits, family care benefits (benefits for transportation, Lodging and/or Childcare) are available under the Certificate.

Contributions

Eligibility:

All full-time employees who work at least thirty hours per week are eligible for coverage the first of the month following their date of hire.

Your EAP Benefit

ACHHH offers an Employee Assistance Program at no cost to employees.

At times, all of us experience personal problems which seem too difficult to handle alone. Often we may discuss these problems with a close friend or relative. Seeking professional guidance can be difficult, especially when we do not know where to turn. That is where the Employee Assistance Program (EAP) can help.

The Employee Assistance Program (EAP) is a confidential counseling/referral service available to all employees and their eligible household members. The program is designed to help those experiencing difficulties which may interfere with personal health, family relationships or their job responsibilities.

Contributions

This is 100% Employer paid.

Eligibility

All employees and their immediate household members are eligible to use the program.

Your Tuition Assistance Benefit

EXCITING BENEFIT FOR EMPLOYEES!

The ACHHH tuition assistance program is designed to help ACHHH employees pay back student loan debt and improve their financial well-being.

Utilizing ACHHH’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Eligibility:

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

Minimum age requirement: In order to participate in the plan, you must be at age 21.

Contact Information

Phone: (844) GRADFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click the link below:

The Richards Group

Your Retirement Benefits

ACHHH offers employees a 401(k) retirement plan.

- You may contribute up to the IRS maximum of $20,500 in 2022 ($6,500 additional if you’re 50 or older)

- Your contributions can be: Pre-Tax or After-Tax (Roth)

- Includes 4% employer match

- The employer safe harbor match contribution is immediately 100% vested.

- Investment options available as either Targeted Date Funds or individual funds.

- Bi-annual visits from Financial Advisor to meet one-one or available via email and telephone.

- Distributions under the plan can only happen under certain parameters

- Retirement, Termination, Death or Disability

- Financial hardship

Eligibility

All employees are eligible (non-resident aliens are excluded).

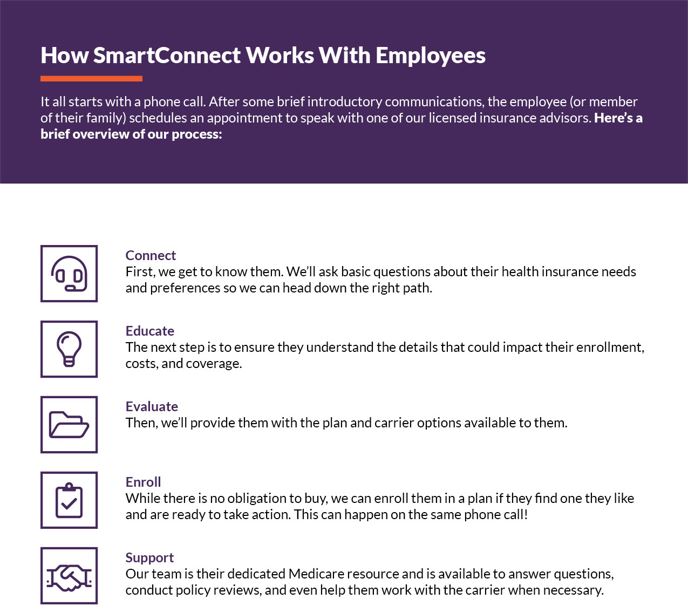

SmartConnect - Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

Additional Information